Consumer Spending Decline: Is US Recession Imminent?

The recent decline in US consumer spending metrics has sparked widespread debate among economists and analysts regarding the immediate future of the economy and the potential for an impending recession.

In the intricate dance of economic indicators, few metrics hold as much sway and predictive power as consumer spending. It’s the lifeblood of economies, fueling demand, production, and employment. When whispers of decline begin, especially concerning Financial News: Consumer Spending Declines – Is a Recession Imminent?, the financial world holds its breath, scanning for the faintest tremors that might signal a larger upheaval. The question on everyone’s mind is not just if, but when, and how severe such a downturn might be.

understanding consumer spending dynamics

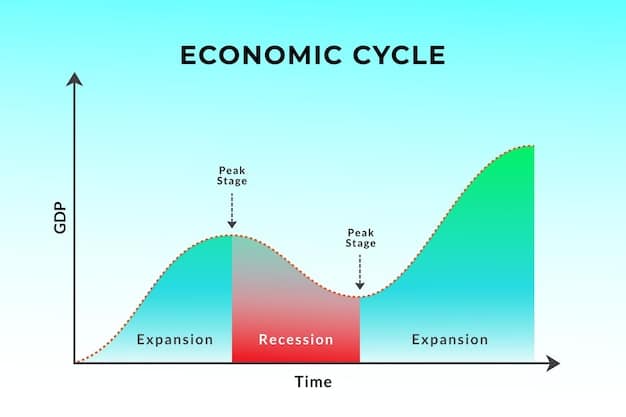

Consumer spending, often referred to as personal consumption expenditures (PCE), represents the total money spent by households on goods and services. It’s a critical component of Gross Domestic Product (GDP) in most developed economies, typically accounting for two-thirds or more of economic activity. Its health is a direct reflection of consumer confidence, employment levels, wage growth, and overall economic stability. A robust consumer spending environment usually signals economic expansion, while a sustained decline can be a precursor to economic contraction or even recession.

Several factors typically influence consumer spending patterns. These include disposable income, which is the money households have left after taxes and other mandatory deductions; consumer confidence, which reflects people’s optimism about their financial future and the economy; interest rates, which affect the cost of borrowing for large purchases; and inflation, which erodes purchasing power. Geopolitical events, global supply chain disruptions, and major technological shifts can also play significant roles in shaping how and where consumers choose to spend their money.

key economic indicators influencing consumer spending

- Inflation Rates: Persistent high inflation can significantly reduce consumers’ purchasing power, forcing them to prioritize essential goods and cut back on discretionary spending.

- Interest Rates: Higher interest rates increase the cost of debt, from mortgages to car loans, potentially deterring large purchases and investments.

- Unemployment Data: Rising unemployment or concerns about job security directly impact consumer confidence and their willingness to spend.

- Wage Growth: Stagnant or declining real wages (after inflation) limit disposable income, making it harder for consumers to maintain their spending levels.

The recent data indicating a decline in consumer spending raises red flags because it suggests a potential shift in these underlying fundamentals. Households might be feeling the pinch of inflation, facing higher borrowing costs, or becoming more cautious due to job market uncertainties. This caution often manifests as reduced discretionary spending, which then ripples through various sectors of the economy, from retail to hospitality.

Analyzing these dynamics requires a nuanced approach, differentiating between temporary dips and sustained trends. A short-term decline caused by a specific event might be quickly absorbed, but a prolonged deceleration in spending, especially across diverse sectors, hints at broader economic weakness that could precede a downturn.

the recent decline: what the data shows

Recent economic reports have indeed painted a concerning picture regarding consumer spending. While definitive figures often lag, preliminary data from retail sales, credit card spending, and various sector-specific surveys indicate a noticeable slowdown. This isn’t just a mild adjustment; in some areas, the drop has been significant enough to catch the attention of analysts across the spectrum.

For instance, retail sales data, after adjusting for inflation, have shown consecutive months of contraction in certain discretionary categories, such as electronics, home furnishings, and apparel. Though essential spending on groceries and utility bills remains relatively stable, the pullback in non-essential purchases signifies a shift in consumer behavior. This shift suggests that households are becoming more prudent with their finances, either due to economic anxieties or a direct impact on their purchasing power.

sectors most affected by decreased spending

- Luxury Goods and High-End Retail: Often the first to feel the squeeze as consumers cut back on non-essential, high-ticket items.

- Travel and Hospitality: Reduced spending on vacations, dining out, and entertainment indicates a tightening of household budgets.

- Automotive and Housing Markets: Higher interest rates combined with economic uncertainty deter major purchases like cars and homes.

- Subscription Services and Discretionary Entertainment: Consumers might prune these expenses to free up cash for necessities.

Credit card spending data also provides valuable insights. While overall debt levels might seem stable, the rate of new credit applications or the total volume of transactions might reveal underlying trends. A decrease in credit card usage for larger purchases, coupled with a rise in defaults or late payments, would suggest financial strain among consumers.

Furthermore, consumer sentiment surveys, which poll individuals about their current financial situation and future economic outlook, have shown a consistent decline. When confidence erodes, people tend to save more and spend less, creating a self-fulfilling prophecy of slower economic activity. This behavioral aspect is crucial; even if the underlying economic fundamentals aren’t catastrophic, a widespread belief in an impending downturn can prompt actions that bring one about.

It’s important to differentiate between a natural economic slowdown following a period of rapid growth and a precipitous decline that signals deep structural issues. The current data points suggest a cautious slowdown rather than a sudden collapse, but the trajectory is unsettling for many.

historical precedents: learning from the past

History offers invaluable lessons when attempting to predict future economic trends. Consumer spending has historically been a strong leading indicator of economic downturns. Prior to almost every major recession in the US, there has been a noticeable and sustained decline in consumer spending, often accompanied by other tell-tale signs like rising unemployment and tightening credit conditions.

Consider the dot-com bust in the early 2000s or the 2008 financial crisis. In both periods, a significant pullback in consumer spending was observed well before the official declaration of a recession. During the 2008 crisis, for example, consumer credit dried up, housing market collapsed, and the general public drastically cut back on both essential and discretionary spending, fearing for their jobs and savings. The swift and severe contraction in consumer demand amplified the economic output decline, leading to one of the deepest recessions in modern history.

parallels and differences with previous downturns

- Similarities: Current high inflation, interest rate hikes, and subdued consumer confidence echo patterns seen before past recessions.

- Differences: The labor market remains relatively strong compared to previous pre-recession periods, and corporate balance sheets are generally healthier.

However, it’s crucial to acknowledge that no two economic cycles are identical. Each downturn has its unique triggers and characteristics. For instance, the COVID-19 pandemic-induced recession was characterized by an unprecedented, sudden stop in economic activity due to health restrictions, rather than a gradual decline in consumer spending. The recovery, too, was unusually swift due to massive fiscal and monetary interventions.

The current environment, while exhibiting some familiar traits like elevated inflation and interest rate hikes, also presents distinct challenges. The labor market, for example, remains surprisingly resilient despite economic headwinds, which is a departure from many historical pre-recession periods where job losses preceded or accompanied consumer spending declines. This resilience could potentially cushion the blow of reduced spending, or it could simply be a lagging indicator that is yet to fully reflect the downturn.

Learning from the past means recognizing patterns without falling into the trap of assuming history will repeat itself precisely. It involves understanding the underlying mechanisms of consumer behavior and how they interact with broader economic forces. While a decline in spending is a significant red flag, its context within the current economic landscape determines whether it’s merely a slowdown or the harbinger of a deeper crisis.

government and central bank responses

When consumer spending shows signs of weakness and a potential recession looms, governments and central banks typically swing into action. Their primary goal is to stabilize the economy, restore confidence, and stimulate demand. These responses can range from monetary policy adjustments by the central bank to fiscal interventions by the government.

The Federal Reserve, as the US central bank, plays a critical role in managing monetary policy. In times of economic slowdown, the Fed might lower interest rates to encourage borrowing and spending, or engage in quantitative easing to inject liquidity into the financial system. Conversely, if inflation is a concern, as it has been recently, the Fed might raise rates to cool down the economy, a move that can inadvertently dampen consumer spending further.

tools in the economic toolbox

- Interest Rate Adjustments: Lowering rates makes borrowing cheaper, stimulating investment and consumption; raising rates curbs inflation but can hinder growth.

- Fiscal Stimulus Packages: Government spending on infrastructure, tax cuts, or direct aid to citizens can inject money into the economy, boosting demand.

- Unemployment Benefits and Social Safety Nets: These provide a buffer for individuals and help maintain a baseline level of consumer spending during downturns.

On the fiscal side, the government can implement various measures. This might include direct stimulus checks, as seen during the pandemic, or increased government spending on infrastructure projects to create jobs and boost economic activity indirectly. Tax cuts can also be used to leave more disposable income in consumers’ hands, encouraging them to spend.

However, the effectiveness and appropriateness of these responses are often subjects of intense debate. For instance, aggressive interest rate hikes aimed at taming inflation could push an already slowing economy into a recession. Similarly, large fiscal stimulus packages, while beneficial in the short term, can lead to increased national debt and future inflationary pressures.

The current economic climate presents a unique challenge for policymakers. They are attempting to navigate persistent inflation while simultaneously monitoring the cooling effects on consumer spending. The balancing act is delicate: applying enough pressure to bring down prices without stifling growth to the point of a recession. The timing and magnitude of these interventions are crucial, and any misstep could exacerbate economic instability.

impact on ordinary americans

While economic indicators and policymaker decisions often seem abstract, their real-world consequences are deeply felt by ordinary Americans. A decline in consumer spending, particularly if it leads to a recession, can have profound impacts on household budgets, employment, and overall quality of life.

The most immediate effect for many is on their job security. As consumer demand wanes, businesses may experience reduced sales and lower profits, leading them to cut costs. This often translates to hiring freezes, reduced hours, or, in more severe cases, layoffs. A ripple effect can then follow, with fewer jobs leading to lower overall income, which further depresses consumer spending, creating a vicious cycle.

how a spending decline impacts households

- Job Security and Income: Increased risk of layoffs or reduced working hours, directly impacting household income.

- Savings and Investments: Economic uncertainty often leads to a draw-down of savings or a decline in investment values, impacting long-term financial goals.

- Debt Burdens: Maintaining debt becomes harder with reduced income, potentially leading to increased delinquencies and defaults.

- Cost of Living: While a decline in spending might eventually lead to lower inflation, initial phases could still see high prices eroding purchasing power.

For those still employed, the rising cost of living due to inflation, coupled with potentially stagnant wages, means that their purchasing power is diminished. Everyday essentials, from groceries to gasoline, become more expensive, leaving less money for discretionary items or savings. This can force families to make difficult choices, prioritizing needs over wants and potentially delaying major life events like buying a home or sending children to college.

Homeowners might face challenges if housing prices decline or if rising interest rates impact their adjustable-rate mortgages. Those with significant credit card debt could see their interest payments climb, making it harder to pay down debt. Small business owners, who often rely heavily on local consumer spending, are particularly vulnerable during such periods, facing reduced sales and potential closures.

The psychological impact should also not be underestimated. Economic uncertainty can lead to increased stress, anxiety, and a general sense of pessimism about the future. This emotional toll can affect mental health and overall well-being, influencing family dynamics and community spirit. Understanding these human dimensions is crucial to grasping the full scope of economic shifts.

the road ahead: possibilities and predictions

Predicting the future of the economy is inherently complex, fraught with variables and uncertainties. While the recent decline in consumer spending is a significant indicator, it doesn’t automatically guarantee a recession. Economists and analysts offer a range of perspectives, from cautious optimism to outright warnings of an impending downturn.

One school of thought suggests that the current slowdown in consumer spending is a necessary correction following a period of excessive demand fueled by pandemic-era stimulus and low interest rates. From this perspective, a “soft landing”—a controlled deceleration of the economy without a full-blown recession—is still possible. This scenario assumes that inflation will continue to moderate, interest rates will stabilize, and the labor market, while perhaps softening, will not collapse.

Conversely, many other experts argue that the signs are too strong to ignore. They point to the inverted yield curve (a historical predictor of recessions), persistent inflation, and the Federal Reserve’s aggressive rate hikes as converging factors that make a recession highly probable. They believe that the decline in consumer spending is merely the vanguard of a broader economic contraction, with job losses and further cuts in discretionary spending soon to follow.

potential scenarios for the u.s. economy

- Soft Landing: Inflation cools, employment remains relatively strong, and growth slows but avoids negative territory.

- Mild Recession: Brief period of economic contraction, characterized by moderate job losses and a quicker recovery aided by policy interventions.

- Deep Recession: Prolonged economic downturn with significant job losses, widespread business failures, and a slow, painful recovery.

Adding to the complexity are global factors. Geopolitical tensions, ongoing supply chain issues, and economic slowdowns in major trading partners can all exert external pressure on the US economy, potentially exacerbating domestic weaknesses. China’s economic performance, for example, heavily influences global supply chains and demand for US exports.

Ultimately, the trajectory of the US economy will depend on a confluence of factors: the Federal Reserve’s ability to fine-tune monetary policy without overshooting, the government’s willingness and capacity to implement effective fiscal measures, and the resilience of American consumers and businesses. While a recession might not be inevitable, preparing for one by strengthening personal and corporate balance sheets seems a prudent course of action for individuals and entities alike.

The coming months will be critical in determining the economy’s path, as more data emerges on consumer behavior, inflation, and employment. Vigilance, adaptability, and informed decision-making will be key.

strategies for consumers and businesses

In an environment where consumer spending is declining and recession fears loom, both individuals and businesses need to adopt proactive strategies to navigate potential economic turbulence. Preparedness can mean the difference between weathering the storm and succumbing to its pressures.

For consumers, the primary focus should be on building financial resilience. This means prioritizing savings, especially an emergency fund sufficient to cover several months of living expenses. Reducing non-essential spending and paying down high-interest debt, like credit card balances, can free up cash flow and reduce financial vulnerability. It’s also wise to review household budgets, identifying areas where expenses can be trimmed without significantly impacting quality of life.

consumer resilience strategies

- Build Emergency Savings: Aim for 3-6 months of living expenses in an easily accessible account.

- Reduce High-Interest Debt: Prioritize paying off credit cards and other expensive loans to lower monthly outgoings.

- Review and Cut Discretionary Spending: Identify and eliminate non-essential expenses to free up cash.

- Diversify Income Streams: Explore side hustles or opportunities for additional income to bolster financial security.

Businesses, particularly those heavily reliant on consumer purchases, must also adapt. Diversifying revenue streams, controlling inventory levels, and optimizing supply chains can provide crucial buffers. Focusing on core competencies and delivering exceptional value can help retain customer loyalty even during lean times. Many businesses will also need to reassess their pricing strategies to remain competitive while managing their own rising operational costs.

Moreover, fostering strong customer relationships becomes even more critical. Loyalty programs, personalized marketing, and responsive customer service can help businesses retain market share when consumers are cutting back. For businesses that operate internationally, monitoring global economic trends and currency fluctuations is vital for mitigating risks and identifying new opportunities.

Investing in employee training and retaining skilled labor can be a strategic move, ensuring that when the economy rebounds, the business is well-positioned to capitalize on renewed demand. Maintaining healthy cash reserves is also paramount, providing liquidity to cover operational expenses and withstand periods of reduced revenue.

Ultimately, proactive planning, prudent financial management, and a focus on core value will be essential for both consumers and businesses to navigate the uncertain economic landscape that lies ahead. Flexibility and adaptability will be key virtues.

| Key Point | Brief Description |

|---|---|

| 📉 Consumer Spending Decline | Recent data shows a noticeable slowdown in US household spending, especially in discretionary areas. |

| ⏳ Recession Risk | Historically, sustained consumer spending declines often precede economic recessions. |

| 🏛️ Policy Responses | Government and central bank actions (interest rates, fiscal stimulus) are crucial but challenging. |

| 💼 Preparedness | Consumers and businesses should adopt defensive strategies, like saving and debt reduction. |

Frequently Asked Questions

Consumer spending, or personal consumption expenditures, is the total money spent by households on goods and services. It’s crucial because it typically accounts for over two-thirds of economic activity in the US, making it a primary driver of GDP, employment, and overall economic health. A healthy spending environment indicates confidence and stability.

A sustained decline in consumer spending often indicates reduced consumer confidence, job insecurity, or eroded purchasing power due to factors like inflation or high interest rates. Since spending drives a significant portion of the economy, a prolonged pullback can lead to businesses cutting production, reducing employment, and ultimately, economic contraction or recession.

Several factors contribute to the current spending decline. Persistent high inflation has reduced real purchasing power, making goods and services more expensive. Aggressive interest rate hikes by the Federal Reserve have increased borrowing costs for loans and mortgages, discouraging large purchases. General economic uncertainty also leads consumers to save more and spend less.

Central banks like the Federal Reserve adjust monetary policy, primarily through interest rates, to influence spending and inflation. Governments deploy fiscal measures like tax cuts or increased public spending. The challenge is balancing inflation control with economic growth, as aggressive measures to curb inflation can further dampen consumer spending and potentially trigger a recession.

To prepare, ordinary Americans should prioritize building an emergency fund (3-6 months of living expenses), reducing high-interest debt, and reviewing their household budgets to identify areas for cost-cutting. Diversifying income streams through side hustles and maintaining a focus on core financial health can also provide greater security during uncertain economic times.

Conclusion

The cooling of consumer spending in the US is a significant economic development that warrants close attention. While not a definitive predictor, its historical correlation with economic downturns makes it a critical warning sign. The interplay of inflation, interest rates, and evolving consumer sentiment creates a complex economic tapestry where the path ahead remains uncertain. For both policymakers and the public, vigilance, informed decision-making, and proactive financial planning will be essential to navigate the potential challenges and opportunities that lie ahead, ensuring the economy can weather any coming storms.