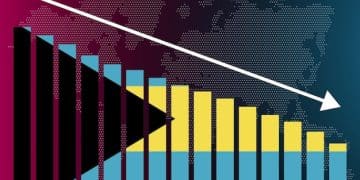

Rising Interest Rates: Housing Market Impact 2025 Analysis

The analysis of the impact of rising interest rates on the housing market in 2025 indicates a potential cooling trend, with reduced affordability, decreased demand for mortgages, and a rebalancing of supply and demand, influencing home prices and sales volumes across various US regions.

As we approach 2025, a critical question for many homeowners, potential buyers, and investors revolves around the Analysis: Impact of Rising Interest Rates on the Housing Market in 2025. Understanding these dynamics is not merely an academic exercise; it provides crucial insights for navigating one of the most significant personal and national economic landscapes. The interplay between borrowing costs and housing affordability shapes everything from individual homeownership dreams to broader economic stability. This analysis delves into the multifaceted effects expected as interest rates continue their upward trajectory.

Understanding the Current Economic Landscape

The beginning of any robust market analysis necessitates a clear understanding of the current economic climate, particularly as it pertains to monetary policy. Central banks, notably the Federal Reserve in the US, have been actively engaged in curbing inflation through interest rate hikes, a strategy that inevitably reverberates throughout the economy, with the housing sector often feeling the tremors first. This proactive stance is designed to cool an overheated economy, but its precise impact on a sector as complex as housing is always a subject of intense debate and forecasting.

Current inflation levels, while showing signs of moderation, remain above target levels for many economic policymakers. This persistent inflationary pressure suggests that interest rates may not quickly revert to the ultra-low levels seen in previous years. Furthermore, global economic uncertainties, from geopolitical tensions to supply chain disruptions, continue to add layers of complexity, making the path forward for interest rates less predictable than ever. The resilience of the labor market, despite some cooling, also plays a significant role, as employment stability underpins consumer confidence and, by extension, housing demand.

The Federal Reserve’s Stance and Future Projections

The Federal Reserve’s dual mandate of maximum employment and price stability guides its monetary policy decisions. As inflation persists, the Fed’s primary tool remains the federal funds rate, which influences a wide array of other interest rates, including those for mortgages. Future projections from the Fed and other economic institutions generally indicate a period of higher-for-longer interest rates, meaning a swift return to pre-pandemic low rates is unlikely in the near term. This outlook is crucial for understanding the prevailing lending environment in 2025.

Global Economic Factors Influencing US Rates

Beyond domestic policy, global economic conditions exert considerable influence. International capital flows, the strength of the US dollar, and economic performance in major trading partners can all indirectly affect long-term interest rates in the US. A slowdown in global growth, for instance, might create disinflationary pressures, potentially allowing central banks to ease their stance. Conversely, persistent global inflation or heightened geopolitical risks could necessitate continued hawkish policies. The interconnectedness of global finance means these external factors cannot be overlooked when projecting the housing market’s future. The current economic landscape thus paints a picture of deliberate tightening alongside external volatilities, setting the stage for significant shifts in housing.

How Rising Interest Rates Directly Impact Housing Affordability

The most immediate and palpable effect of rising interest rates on the housing market is their direct impact on affordability. When the cost of borrowing increases, monthly mortgage payments inevitably rise, even if home prices remain constant. This fundamental relationship means that for a given income level, prospective buyers can afford less housing, or alternatively, need a higher income to afford the same level of housing they could previously. This phenomenon has far-reaching consequences, affecting demand, inventory, and ultimately, home values.

Mortgage rates, particularly for 30-year fixed-rate mortgages, are highly sensitive to changes in the federal funds rate and broader bond market yields. As these rates climb, even by a small percentage point, the financial burden on buyers escalates significantly. For instance, a half-point increase on a typical mortgage loan can add hundreds of dollars to a monthly payment, pushing many potential buyers out of the market or forcing them to reconsider their housing aspirations. This direct correlation between interest rates and monthly payments is the primary mechanism through which affordability erodes.

The Mortgage Payment Equation

Understanding how mortgage payments are calculated reveals the sensitivity to interest rates. The principal and interest portion of a mortgage payment is directly proportional to the interest rate. Higher rates mean a larger share of the monthly payment goes towards interest, limiting the principal reduction and extending the overall cost of the loan. This can lead to a phenomenon where even if home prices stabilize or slightly decrease, the overall cost of homeownership can still increase due to higher financing costs. This financial squeeze is felt most acutely by first-time homebuyers and those with limited down payments, as they are more reliant on favorable lending terms.

Impact on Different Buyer Segments

The impact of reduced affordability is not uniform across all buyer segments:

* First-time Homebuyers: Often the most vulnerable, as they typically have less equity to leverage and rely on smaller down payments. Higher rates make it harder to qualify for loans and to save enough for a down payment.

* Mid-tier Buyers: May face challenges moving up, as the cost of a larger home becomes prohibitive, locking them into their current residences.

* Luxury Market: Generally less affected, as buyers in this segment often have substantial cash reserves or are less sensitive to marginal increases in borrowing costs.

The erosion of affordability due to rising interest rates creates a formidable barrier to entry for many, reshaping the demographic profile of who can afford to buy a home and where. This shift could lead to longer rental periods for many, further impacting personal wealth accumulation and broader economic mobility.

Projected Changes in Housing Demand and Supply in 2025

The intricate dance between demand and supply largely dictates the health and direction of any market, and the housing sector is no exception. As interest rates escalate, the dynamics of both demand and supply are profoundly altered. On the demand side, higher borrowing costs deter potential buyers, leading to a notable slowdown in market activity. Concurrently, rising rates can also influence sellers’ decisions, impacting the inventory of homes available.

A primary effect on demand comes from diminished purchasing power. As explored previously, higher mortgage payments mean fewer qualified buyers, leading to a contraction in overall demand for housing. This is particularly true for discretionary buyers or those stretching their budgets to enter the market. Investor demand may also wane as the cost of leverage increases, making rental properties less attractive as investments if yields don’t keep pace. This cooling of demand is a natural consequence of tighter monetary conditions, aiming to rebalance a market that has seen significant price appreciation.

The Supply Response: Seller Hesitation and New Construction

On the supply side, the picture is more nuanced. Existing homeowners may become reluctant sellers if moving means trading their current low-interest mortgage for a new, higher-interest one. This “lock-in” effect can restrict the flow of inventory onto the market, even as demand softens. While higher rates cool demand, they also can constrain supply by disincentivizing existing homeowners from selling, especially those who locked in historically low rates. This creates a challenging paradox where fewer buyers chase fewer available homes.

New construction also feels the pinch. Developers face higher borrowing costs for construction loans, which can delay or halt new projects. Coupled with persistent labor shortages and elevated material costs, this can further limit the supply of new homes entering the market.

* Reduced Buyer Pool: Fewer individuals and families can afford current home prices with higher interest rates.

* “Lock-in” Effect: Existing homeowners with low mortgage rates are disincentivized from selling, reducing available inventory.

* Slower New Construction: Developers face increased costs and reduced profit margins, leading to fewer new homes being built.

* Market Rebalancing: The shift creates a more balanced market, moving away from the seller’s market of recent years.

The net effect is a market grappling with a dual challenge: softening demand due to affordability constraints and potentially constrained supply due to seller hesitation and curtailed new construction. This delicate balance will determine the extent of price corrections and market activity in 2025. This dynamic interplay can lead to a period of market rebalancing, moving away from the intense seller’s market seen in recent years towards a more neutral or even buyer-favored environment in some segments.

Regional Variations and Their Expected Performance

It is crucial to recognize that the impact of rising interest rates will not be uniformly distributed across the United States. The housing market is inherently local, defined by specific economic drivers, job growth rates, population migration patterns, and existing housing stock characteristics. While nationwide trends provide a general direction, the true effects will manifest differently in various regions, leading to a patchwork of performance in 2025.

Regions that experienced the most aggressive price appreciation during the low-interest-rate environment are often the most vulnerable to significant corrections when rates rise. These “boomtowns” might see sharper declines in home values as affordability issues become more pronounced and speculative interest wanes. Conversely, more stable, established markets with diverse economies and steady demand may prove more resilient, experiencing slower growth or modest declines rather than sharp drops.

Factors Influencing Regional Performance

Several key factors will determine how individual markets react:

* Economic Diversity: Regions with diverse industries and strong job markets are better positioned to absorb interest rate shocks.

* Population Growth: Areas with robust in-migration (e.g., Sun Belt states) may continue to see underlying demand, moderating price declines.

* Housing Supply: Markets with an existing housing shortage may experience less severe price corrections, as basic supply-demand imbalances persist.

* Affordability Prior to Rate Hikes: Markets that were already stretched on affordability will feel the pinch of rising rates more intensely.

* Investor Activity: Regions heavily reliant on investor purchases may see more significant pullbacks as financing costs increase.

For instance, markets like Austin, Boise, or Phoenix, which saw explosive growth fueled by remote work and speculative buying, could face more significant adjustments. Their rapid appreciation left them highly sensitive to affordability pressures, making them ripe for corrections. In contrast, markets in the Northeast or Midwest, which experienced more moderate growth, might see less dramatic shifts.

* Sun Belt Cities: Expected to see more noticeable price adjustments due to their rapid growth and recent affordability stretch.

* Coastal Hubs (e.g., California, Northeast): High existing prices mean even slight rate increases can push many buyers out, but limited supply often provides a floor.

* Midwest Markets: Generally more stable and affordable, likely to experience milder slowdowns or continued modest growth.

The critical takeaway is that a granular, regional approach is necessary when assessing the impact of rising interest rates. Generalizations will miss the nuances of local economies and housing market dynamics, underscoring the importance of localized data and analysis for accurate forecasting in 2025. Investors and prospective homeowners alike should study local market conditions rather than relying solely on national averages.

Potential Economic Ripple Effects Beyond Housing

The housing market is not an isolated component of the economy; it is deeply intertwined with broader economic health. Changes in housing prices and activity levels can create significant ripple effects, influencing consumer spending, construction employment, financial sector stability, and even government policy. Understanding these wider ramifications is essential for a comprehensive analysis of rising interest rates.

When home values decline or stagnate, and home sales activity slows, it can lead to a “negative wealth effect.” Homeowners may feel less wealthy and, consequently, reduce their spending on other goods and services. This contraction in consumer spending, which forms a large portion of economic activity, can contribute to a broader economic slowdown or even recession. Conversely, a stable or appreciating housing market tends to bolster consumer confidence and spending.

Impact on Related Industries

The slowdown in housing directly impacts several related industries. Construction, real estate brokerage, mortgage lending, and home improvement sectors are particularly vulnerable. Reduced home construction means fewer jobs in building trades and less demand for building materials. Slower sales translate to less commission income for real estate agents and fewer loan originations for mortgage lenders, potentially leading to job losses in these sectors.

Furthermore, lower transaction volumes and potentially lower home prices could impact property tax revenues for local governments, affecting public services. The financial sector also bears watching: while the stricter lending standards implemented since the 2008 crisis provide better protection, significant housing downturns can still stress bank balance sheets if defaults rise, though this is considered less likely under current conditions.

Wider Economic Implications: Inflation and Policy

The Federal Reserve, in raising rates, aims to cool the economy and reduce inflation. A significant slowdown in the housing market can contribute to this disinflationary process by reducing aggregate demand. However, there’s a delicate balance: too sharp a contraction could lead to an undesirable recession. Therefore, central banks will closely monitor housing data as a key indicator of their policy effectiveness and potential need for adjustments. The housing market thus serves as both a bellwether and a transmission mechanism for broader economic policy. Its performance in 2025 will be a critical determinant of not just personal wealth, but also macroeconomic stability and future policy decisions.

Strategies for Buyers, Sellers, and Investors in 2025

Navigating a housing market influenced by rising interest rates and potential shifts requires a strategic approach from all participants: buyers, sellers, and investors. Understanding the evolving dynamics and adapting one’s plans can mitigate risks and uncover opportunities in 2025. The conventional wisdom formed during periods of rapid appreciation may no longer apply, demanding a more nuanced perspective.

For prospective homebuyers, the emphasis shifts from speed to prudence. Patience becomes a virtue, as higher rates may lead to fewer bidding wars and potentially more inventory. This allows for more thorough due diligence and less pressured decision-making. Reassessing affordability in light of higher monthly payments is paramount, ensuring that the purchase remains sustainable. Exploring different mortgage products, such as adjustable-rate mortgages (ARMs) for shorter-term residency plans, might also become more relevant, though with increased risk.

Advice for Homebuyers

* Re-evaluate Budgets: Understand how higher rates impact your maximum affordable price and monthly payment.

* Strengthen Financial Position: Focus on improving credit scores and increasing down payments to secure better terms.

* Be Patient: Less intense competition might mean more negotiation room and time to find the right property.

* Consider Location Carefully: Focus on resilient markets with strong fundamentals.

* Explore All Mortgage Options: Understand the pros and cons of fixed vs. adjustable rates for your specific needs.

Advice for Home Sellers

Sellers may need to adjust their expectations. The days of multiple cash offers well above asking price might be temporarily over. Pricing homes realistically from the outset becomes crucial to attract buyers in a more competitive environment. Focusing on marketing and staging to make properties stand out, and being open to negotiations, will be key strategies. Those “locked in” by low rates may choose to stay put, further tightening supply.

* Price Competitively: Avoid overpricing; market conditions will not support aggressive pricing strategies common in recent years.

* Enhance Property Value: Small improvements and professional staging can make a big difference in attracting discerning buyers.

* Be Flexible: Be prepared to negotiate on price and terms.

* Understand the “Why” of Selling: If selling is discretionary, consider waiting for more favorable market conditions.

Advice for Investors

Investors will need to adapt their models to account for higher borrowing costs and potentially lower appreciation rates. The focus may shift from rapid capital appreciation to stable rental income and long-term holds. Identifying undervalued properties in stable markets, or exploring alternative investment strategies like REITs, might become more attractive. Due diligence on potential rental yields and tenant demand becomes critical.

* Focus on Cash Flow: Ensure rental income sufficiently covers higher mortgage payments and operating costs.

* Long-Term Hold: Shift focus from quick flips to long-term appreciation and consistent rental returns.

* Target Resilient Markets: Invest in areas with strong economic fundamentals and consistent rental demand.

* Diversify: Consider expanding investment portfolios beyond single-family homes to include multi-family or commercial properties.

Ultimately, all market participants will need to display agility and a keen awareness of specific local market conditions. The period of rapid, largely unchecked growth in housing appears to be easing, giving way to a more normalized, and arguably healthier, market environment that demands thoughtful and strategic decision-making.

Navigating the Path to a Balanced Housing Market

The trajectory of the US housing market in 2025, heavily influenced by rising interest rates, points towards a crucial rebalancing. After years of intense upward pressure on prices and fierce competition among buyers, the market is entering a phase characterized by moderation, increased affordability challenges, and a necessary recalibration of expectations. This shift, though potentially uncomfortable for some, is vital for long-term sustainability and market health.

A balanced market is one where neither buyers nor sellers hold undue advantage. It is characterized by reasonable inventory levels, a healthy pace of sales, and price appreciation that aligns more closely with income growth and inflation, rather than outstripping it. The current interest rate environment is acting as a natural, albeit powerful, corrective mechanism, designed to cool demand and temper price growth. This process of rebalancing is not instantaneous but will unfold throughout 2025, with varying degrees of intensity across different regions.

Key Indicators of a Rebalancing Market

Several key indicators will signal the progression towards a more balanced market:

* Increasing Inventory: More homes staying on the market longer, providing buyers with more choices.

* Fewer Bidding Wars: Reduced competition, leading to fewer offers significantly above asking price.

* Slower Price Appreciation: Home values stabilizing or experiencing modest declines in some areas, rather than rapid increases.

* Longer Days on Market: Homes taking more time to sell, indicating a less frenzied pace.

* Increased Buyer Leverage: Buyers gaining more negotiation power on price and contingencies.

The path to balance involves a delicate interplay of monetary policy, economic fundamentals, and consumer psychology. While the immediate outlook may present headwinds for some, particularly those accustomed to the boom years, a market that operates within sustainable parameters ultimately benefits everyone by reducing the risk of speculative bubbles and ensuring broader access to homeownership for future generations. The adjustments in 2025, though perhaps challenging, are foundational for securing the long-term health and stability of the housing sector.

| Key Point | Brief Description |

|---|---|

| 💸 Affordability Decline | Rising mortgage rates directly increase monthly payments, reducing purchasing power for many buyers. |

| 📉 Demand Contraction | Higher costs deter potential buyers, leading to fewer sales and a general slowdown in market activity. |

| 📊 Regional Divergence | Impact varies significantly by location; overheated markets may see sharper corrections. |

| ⚖️ Market Rebalancing | Shift from a strong seller’s market to a more balanced environment with increased buyer leverage. |

Frequently Asked Questions About the 2025 Housing Market

▼

While a widespread “crash” is unlikely, many experts anticipate price moderation or modest declines in some overvalued markets. Rapid price appreciation, typical of recent years, is expected to slow significantly due to decreased affordability reducing demand. The severity will highly depend on local economic conditions.

▼

For homebuyers, rising rates mean higher monthly mortgage payments and reduced purchasing power. This leads to increased selectivity and slower decision-making. First-time buyers may find it more challenging to qualify for loans, potentially prolonging their rental periods or requiring them to target lower-priced homes.

▼

Residential construction typically slows when interest rates rise, as financing becomes more expensive for developers and demand for new homes softens. While some master-planned communities with robust pre-sales may continue, overall new housing starts are expected to temper, exacerbating supply shortages in the long run.

▼

Indeed. A cooling market can bring increased inventory, fewer bidding wars, and more negotiation room for buyers. It fosters a healthier, more sustainable market environment, reducing speculative activity and allowing prices to align more closely with fundamental economic values. Patience and strategic planning become key advantages.

▼

Regions with strong, diverse economies and continued population growth will likely be more resilient. Overheated markets that saw rapid appreciation are more susceptible to price corrections. Buyers and sellers should focus on localized data and trends, as the housing market remains fundamentally a local phenomenon, with significant variations.

Conclusion

The analysis of the impact of rising interest rates on the housing market in 2025 paints a picture of transition rather than collapse. While affordability challenges will intensify for many, leading to a definite cooling of demand and a moderation in price growth, the underlying fundamentals of the US housing market, coupled with stricter lending standards, suggest a period of rebalancing rather than a catastrophic downturn. This rebalancing will be uneven, with regional variations playing a significant role in market performance. For all participants—buyers, sellers, and investors—2025 will demand adaptability, strategic foresight, and a keen understanding of local market nuances to navigate an evolving and normalizing housing landscape successfully.